Renters Insurance in and around Chesapeake

Chesapeake renters, State Farm has insurance for you, too

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

- Chesapeake

- Portsmouth

- Virginia Beach

- Norfolk

- Suffolk

- Hampton Roads

- Southeast Virginia

- Moyock, NC

- Currituck, NC

- Elizabeth City, NC

Insure What You Own While You Lease A Home

Trying to sift through savings options and providers on top of family events, work and managing your side business, is a lot to think about and remember. But your belongings in your rented townhome may need the incredible coverage that State Farm provides. So when mishaps occur, your clothing, electronics and pictures have protection.

Chesapeake renters, State Farm has insurance for you, too

Your belongings say p-lease and thank you to renters insurance

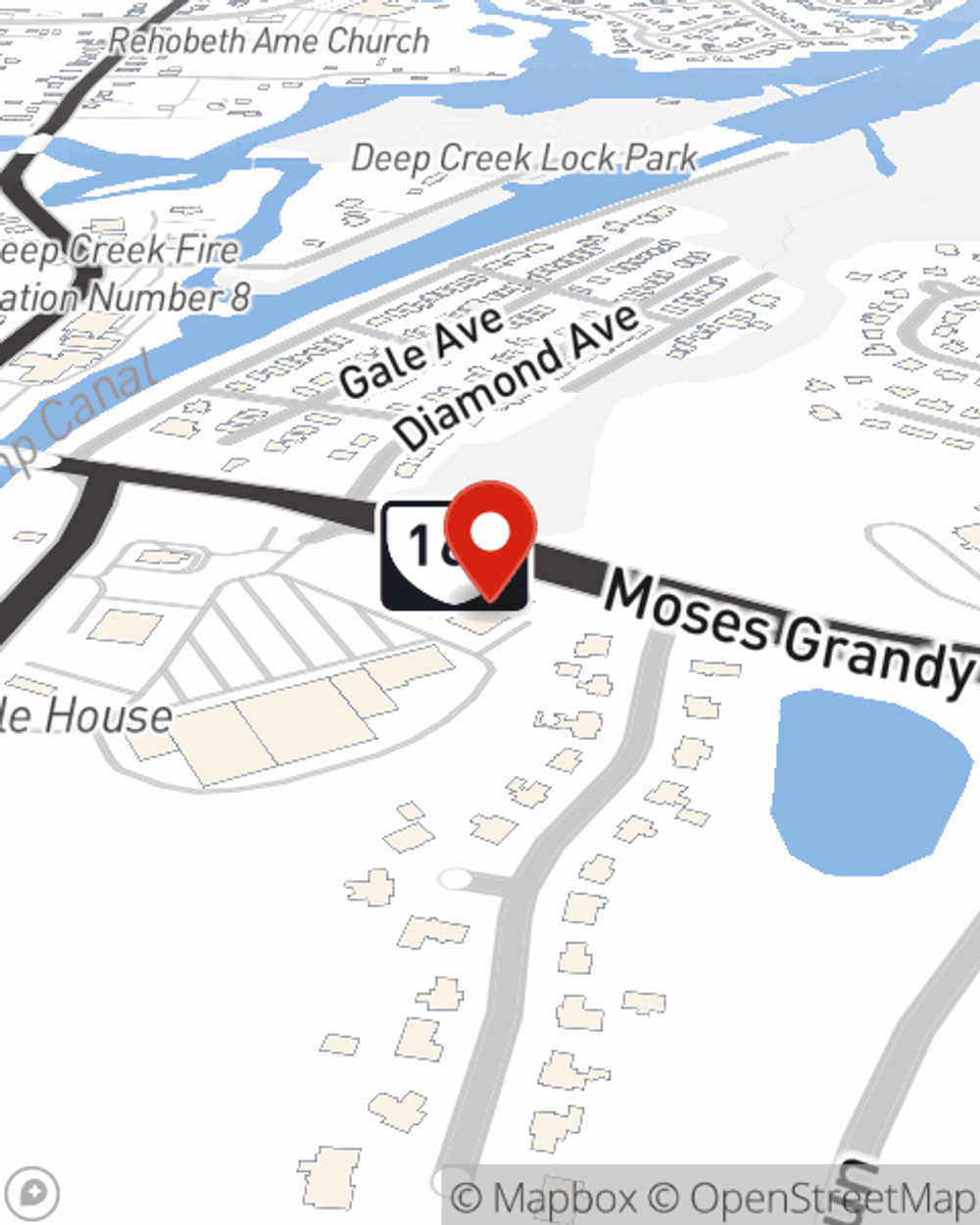

Agent Stewart Deacon, At Your Service

Renters insurance may seem like the least of your concerns, and you're wondering if it's really necessary. But take a moment to think about what it would cost to replace all the belongings in your rented apartment. State Farm's Renters insurance can help when windstorms or tornadoes damage your personal property.

If you're looking for a committed provider that can help with all your renters insurance needs, get in touch with State Farm agent Stewart Deacon today.

Have More Questions About Renters Insurance?

Call Stewart at (757) 606-1950 or visit our FAQ page.

Simple Insights®

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

Stewart Deacon

State Farm® Insurance AgentSimple Insights®

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.